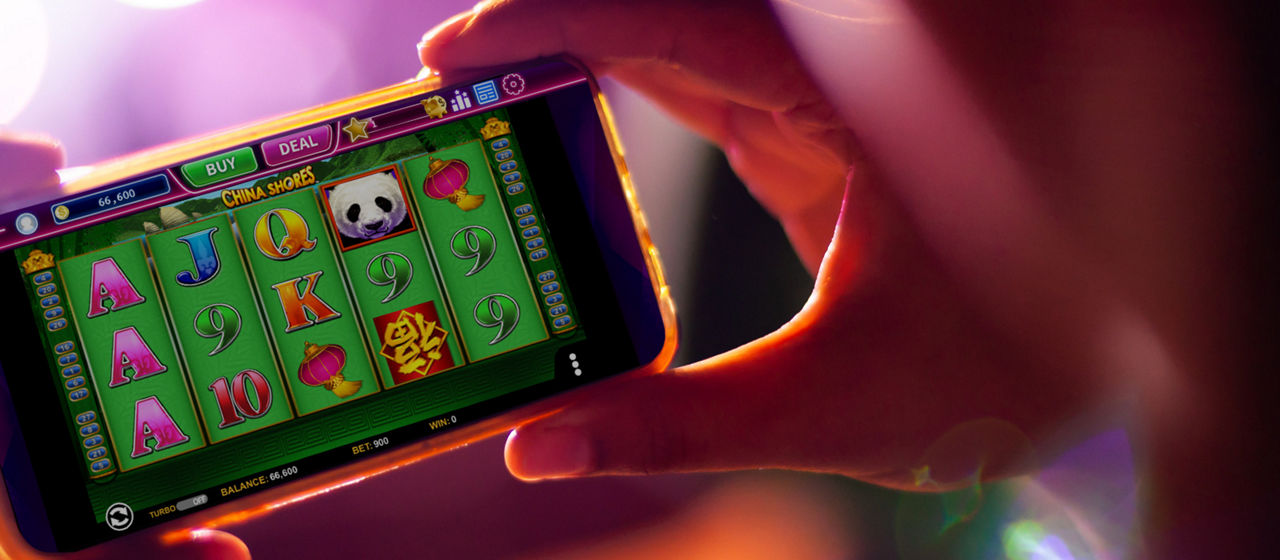

Real money casino slots game

- YouTube

Enjoy the videos and music you love upload original content and share it all with friends family and the world on YouTube.

tc lottery (tclottery97) - Profile Pinterest

tc lottery It offers a variety of games including ones where you can win passive income by using your talents such as win-go slots placing and sports games https://apkjunction.com/tc-lottery-app/

What is the tax on 75 lakh lottery winnings in Kerala?

Over and above the Kerala lottery prize tax of 30% and 4% cess will also be applicable. This brings the effective taxation rate to 31.2%. In the case of the winnings exceeding Rs. 10 lakh an additional 10% surcharge is also applicable.Jun 11 2024

What is the tax on 75 lakh lottery winnings in Kerala?

Over and above the Kerala lottery prize tax of 30% and 4% cess will also be applicable. This brings the effective taxation rate to 31.2%. In the case of the winnings exceeding Rs. 10 lakh an additional 10% surcharge is also applicable.Jun 11 2024

Is lottery legal in India?

The legality of the lottery in India is a state-related affair. Under the Lotteries Regulation Act of 1988 the state governments have been authorised by the central government to make their laws related to the game. As a result some states have banned it and some still consider it legal.26/08/2024

Is lottery legal in India?

The legality of the lottery in India is a state-related affair. Under the Lotteries Regulation Act of 1988 the state governments have been authorised by the central government to make their laws related to the game. As a result some states have banned it and some still consider it legal.26/08/2024

| # | Article Title | Keyword | Article Link | Article Details |

|---|---|---|---|---|

Enjoy the videos and music you love, upload original content, and share it all with friends, family, and the world on YouTube.

tc lottery (tclottery97) - Profile Pinterest

tc lottery | It offers a variety of games, including ones where you can win passive income by using your talents, such as win-go, slots, placing, and sports games https://apkjunction.com/tc-lottery-app/

What is the tax on 75 lakh lottery winnings in Kerala?

Over and above the Kerala lottery prize tax of 30%, and 4% cess will also be applicable. This brings the effective taxation rate to 31.2%. In the case of the winnings exceeding Rs. 10 lakh, an additional 10% surcharge is also applicable.Jun 11, 2024

What is the tax on 75 lakh lottery winnings in Kerala?

Over and above the Kerala lottery prize tax of 30%, and 4% cess will also be applicable. This brings the effective taxation rate to 31.2%. In the case of the winnings exceeding Rs. 10 lakh, an additional 10% surcharge is also applicable.Jun 11, 2024

The legality of the lottery in India is a state-related affair. Under the Lotteries Regulation Act, of 1988, the state governments have been authorised by the central government to make their laws related to the game. As a result, some states have banned it and some still consider it legal.26/08/2024

The legality of the lottery in India is a state-related affair. Under the Lotteries Regulation Act, of 1988, the state governments have been authorised by the central government to make their laws related to the game. As a result, some states have banned it and some still consider it legal.26/08/2024

What is the tax on 1 crore lottery in Kerala?

Lottery tax in Kerala, including cess and surcharge, stands at 31.2%. So the Kerala lottery tax rate will be 31.2% of Rs. 1 crore, that is, Rs.11/06/2024

What is the tax on 1 crore lottery in Kerala?

Lottery tax in Kerala, including cess and surcharge, stands at 31.2%. So the Kerala lottery tax rate will be 31.2% of Rs. 1 crore, that is, Rs.11/06/2024

Where is the Texas Lottery Commission?

Texas Lottery Commission Headquarters in Austin.

Where is the Texas Lottery Commission?

Texas Lottery Commission Headquarters in Austin.

How do I claim my CT lottery winnings?

Winning tickets up to and including $5,000 can be redeemed at any High-Tier Claim Center or CT Lottery Headquarters. Prizes over $5,000 or more must be claimed at CT Lottery Headquarters.

How do I claim my CT lottery winnings?

Winning tickets up to and including $5,000 can be redeemed at any High-Tier Claim Center or CT Lottery Headquarters. Prizes over $5,000 or more must be claimed at CT Lottery Headquarters.

What is the tax on 1 crore lottery winnings in India?

Rate of TDS on Lottery Winnings Example: If you win ₹1 crore (₹1,00,00,000) in a lottery: Basic Tax Deduction: ₹1,00,00,000 × 0.30 = ₹30,00,000. Health and Education Cess: ₹30,00,000 × 0.04 = ₹1,20,000. Total TDS Deducted: ₹30,00,000 + ₹1,20,000 = ₹31,20,000.Sep 11, 2024

What is the tax on 1 crore lottery winnings in India?

Rate of TDS on Lottery Winnings Example: If you win ₹1 crore (₹1,00,00,000) in a lottery: Basic Tax Deduction: ₹1,00,00,000 × 0.30 = ₹30,00,000. Health and Education Cess: ₹30,00,000 × 0.04 = ₹1,20,000. Total TDS Deducted: ₹30,00,000 + ₹1,20,000 = ₹31,20,000.Sep 11, 2024

この単語の読み方は、「ラタリィ」に近い発音をします。 これはアメリカ英語の場合ですが、イギリス英語では、「ロトリィ」や「ロッテリィ」に近い発音

この単語の読み方は、「ラタリィ」に近い発音をします。 これはアメリカ英語の場合ですが、イギリス英語では、「ロトリィ」や「ロッテリィ」に近い発音

How to claim Kerala lottery prize 2000 rupees?

A claim form and a self-attested Photostat copy of the ticket’s front and back. Two photographs (passport size) of the prize winner officially verified by a Gazetted Officer/Notary. An official prize money receipt in the required format bearing the winner’s full address and a revenue stamp for ₹1.Aug 26, 2024

How to claim Kerala lottery prize 2000 rupees?

A claim form and a self-attested Photostat copy of the ticket’s front and back. Two photographs (passport size) of the prize winner officially verified by a Gazetted Officer/Notary. An official prize money receipt in the required format bearing the winner’s full address and a revenue stamp for ₹1.Aug 26, 2024

There are three main types of lotteries: unique number lotteries, selected number lotteries, and scratch cards. Each lottery ticket is sold at 100 to 500 yen, and the top cash prizes are usually 100 million yen or more.

There are three main types of lotteries: unique number lotteries, selected number lotteries, and scratch cards. Each lottery ticket is sold at 100 to 500 yen, and the top cash prizes are usually 100 million yen or more.

What is second chance lottery Colorado?

NEW Monthly $100,000 Second-Chance Drawing Get ready for a thrilling new way to win big! Starting September 1, the Colorado Lottery is introducing a Monthly Second-Chance Bonus Drawing where you could win a whopping $100,000. That’s right—your non-winning Scratch tickets could still make you a winner!Sep 3, 2024

What is second chance lottery Colorado?

NEW Monthly $100,000 Second-Chance Drawing Get ready for a thrilling new way to win big! Starting September 1, the Colorado Lottery is introducing a Monthly Second-Chance Bonus Drawing where you could win a whopping $100,000. That’s right—your non-winning Scratch tickets could still make you a winner!Sep 3, 2024

How much does CT Lottery make?

In fiscal year 2023, the CLC achieved sales of $1.7 billion, $88 million in Retailer commissions, and returned $404 million to the state’s General Fund.

How much does CT Lottery make?

In fiscal year 2023, the CLC achieved sales of $1.7 billion, $88 million in Retailer commissions, and returned $404 million to the state’s General Fund.