What is the tax on lottery winnings in India?

Apply the Tax Rate: Lottery winnings are taxed at a flat rate of 30%. To calculate the basic tax liability, multiply the total winnings by 0.30. Example: If you win ₹1 crore (₹1,00,00,000), the basic tax liability would be ₹1,00,00,000 × 0.30 = ₹30,00,000.11/09/2024

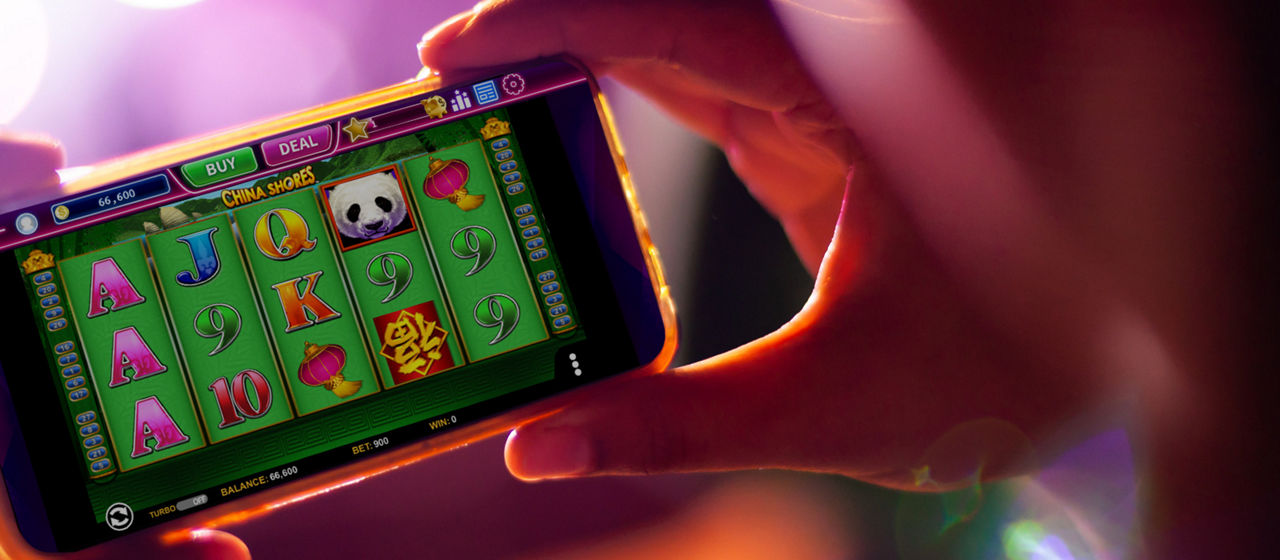

Prediction games and earn money in TC Lottery app

This site only collects related articles. Viewing the original, please copy and open the following link:What is the tax on lottery winnings in India?