Which is Kerala Lottery?

@TC Lottery

Each Monday at 3 PM, the Kerala Lottery “Win Win” lottery draw is conducted. Every lottery has an alphanumeric code to identify it, and the Kerala “WIN WIN” lottery code is “WW” because it includes the draw number as well as the code. The first prize winner of lucky draw will receive bumper 75 Lakh Rupees.قبل 12 ساعة

Can we earn money from a TC lottery?

@TC Lottery

And playing games on Tc Lottery is very simple. You just need to guess the upcoming winning color or number and if you guessed it right then you will be rewarded for it and you can earn up to 2X or 10X or even more of your amount.२०२४ अक्टोबर १८

How to win the national lottery in the UK?

@TC Lottery

To play the National Lottery you need to be over 16 years old. You select 6 different numbers from 1 - 49. Each line of numbers you select costs £1. To win the Jackpot you need to match all 6 numbers from one of your lines to the first 6 numbers drawn from the lottery machine.

What is a TC lottery?

@TC Lottery

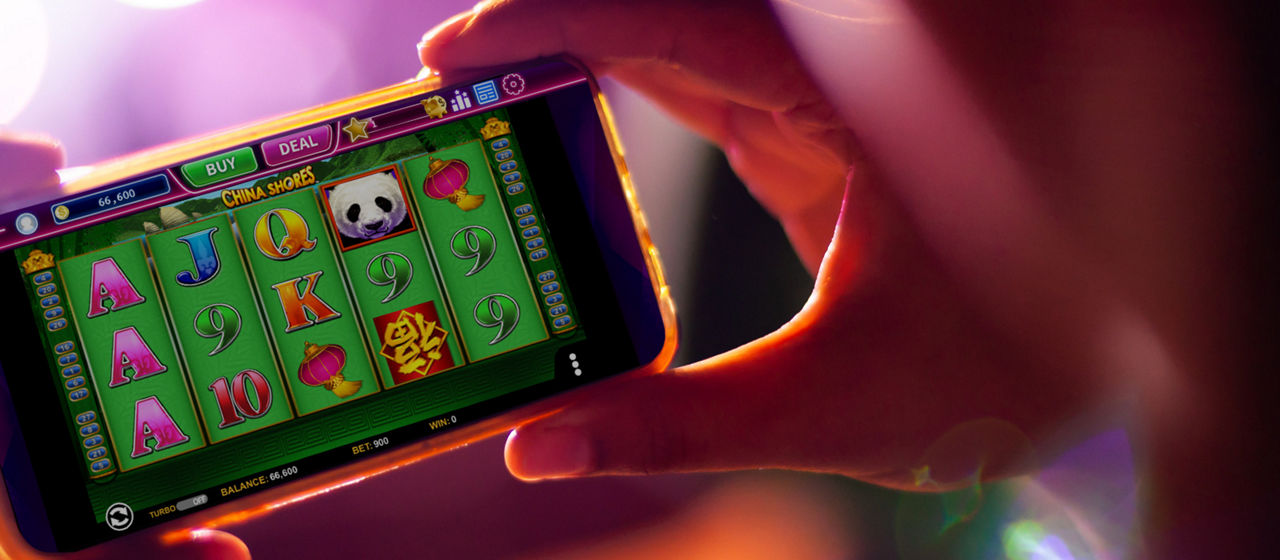

The TC Lottery is an online platform that offers a variety of engaging games, including instant-win scratch-offs, color prediction games, and exciting draws. It provides a seamless gaming experience for users to participate in different games and win real rewards.2024. 3. 14.

What is the tax on lottery winnings in India?

@TC Lottery

Apply the Tax Rate: Lottery winnings are taxed at a flat rate of 30%. To calculate the basic tax liability, multiply the total winnings by 0.30. Example: If you win ₹1 crore (₹1,00,00,000), the basic tax liability would be ₹1,00,00,000 × 0.30 = ₹30,00,000.11/09/2024

What is the tax on lottery winnings in India?

@TC Lottery

Apply the Tax Rate: Lottery winnings are taxed at a flat rate of 30%. To calculate the basic tax liability, multiply the total winnings by 0.30. Example: If you win ₹1 crore (₹1,00,00,000), the basic tax liability would be ₹1,00,00,000 × 0.30 = ₹30,00,000.11/09/2024

Is lottery legal in India?

@TC Lottery

The legality of the lottery in India is a state-related affair. Under the Lotteries Regulation Act, of 1988, the state governments have been authorised by the central government to make their laws related to the game. As a result, some states have banned it and some still consider it legal.26/08/2024

Is lottery legal in India?

@TC Lottery

The legality of the lottery in India is a state-related affair. Under the Lotteries Regulation Act, of 1988, the state governments have been authorised by the central government to make their laws related to the game. As a result, some states have banned it and some still consider it legal.26/08/2024

What is the tax on 1 crore lottery winnings in India?

@TC Lottery

Rate of TDS on Lottery Winnings Example: If you win ₹1 crore (₹1,00,00,000) in a lottery: Basic Tax Deduction: ₹1,00,00,000 × 0.30 = ₹30,00,000. Health and Education Cess: ₹30,00,000 × 0.04 = ₹1,20,000. Total TDS Deducted: ₹30,00,000 + ₹1,20,000 = ₹31,20,000.Sep 11, 2024

What is the tax on 1 crore lottery winnings in India?

@TC Lottery

Rate of TDS on Lottery Winnings Example: If you win ₹1 crore (₹1,00,00,000) in a lottery: Basic Tax Deduction: ₹1,00,00,000 × 0.30 = ₹30,00,000. Health and Education Cess: ₹30,00,000 × 0.04 = ₹1,20,000. Total TDS Deducted: ₹30,00,000 + ₹1,20,000 = ₹31,20,000.Sep 11, 2024

How to claim Kerala lottery prize 2000 rupees?

@TC Lottery

A claim form and a self-attested Photostat copy of the ticket’s front and back. Two photographs (passport size) of the prize winner officially verified by a Gazetted Officer/Notary. An official prize money receipt in the required format bearing the winner’s full address and a revenue stamp for ₹1.Aug 26, 2024

How to claim Kerala lottery prize 2000 rupees?

@TC Lottery

A claim form and a self-attested Photostat copy of the ticket’s front and back. Two photographs (passport size) of the prize winner officially verified by a Gazetted Officer/Notary. An official prize money receipt in the required format bearing the winner’s full address and a revenue stamp for ₹1.Aug 26, 2024